charitable gift annuity calculator

Property you receive as a gift bequest or inheritance isnt included in your income. And should the gift occur prior to the annuity owners age of 59 ½ the transaction will be subject to a 10 IRS early withdrawal penalty.

Gift Calculator Princeton Alumni

The amount will be recalculated each year and the Lead Beneficiaries receive larger payments that year if the CRUTs rate of return exceeds the fixed percentage payout and smaller payments that year if the CRUTs rate of return is less than the fixed percentage payout.

. A MYGA is appropriate for someone who is closer to retirement and prefers tax deferral and a. During most tax years you are required to itemize your deductions to claim your charitable gifts and contributions. Find the solution that fits your charitable goals with the Giving Solutions Guide.

Being this close to the end of the year the gift-giver may want to consider withholding 15000 or 30000 if married of the gift for January so as to avoid wasting their gift tax exemption. A Roth IRA is an individual retirement plan that can be either an account or an annuity and features nondeductible contributions and tax-free distributions. Let Microsoft financial templates take on some of the work.

When an annuity is gifted to another party the transaction triggers a taxable event for the donor. The benefits are three-fold. Try a financial template calculator in Excel to help pay off a car loan student loan or credit card balance.

Save time and money by trusting WatersEdge with your churchs accounting needs. You get a tax break for your charitable gifts if you donate to a qualifying organization and itemize your deductions. If you make a single non-cash.

How to Claim Charitable Donations When You File Your Tax Return. The 2022 RRIF minimum withdrawal rates. Also known as the RRIF Payout Schedule by the Canada Revenue Agency CRA.

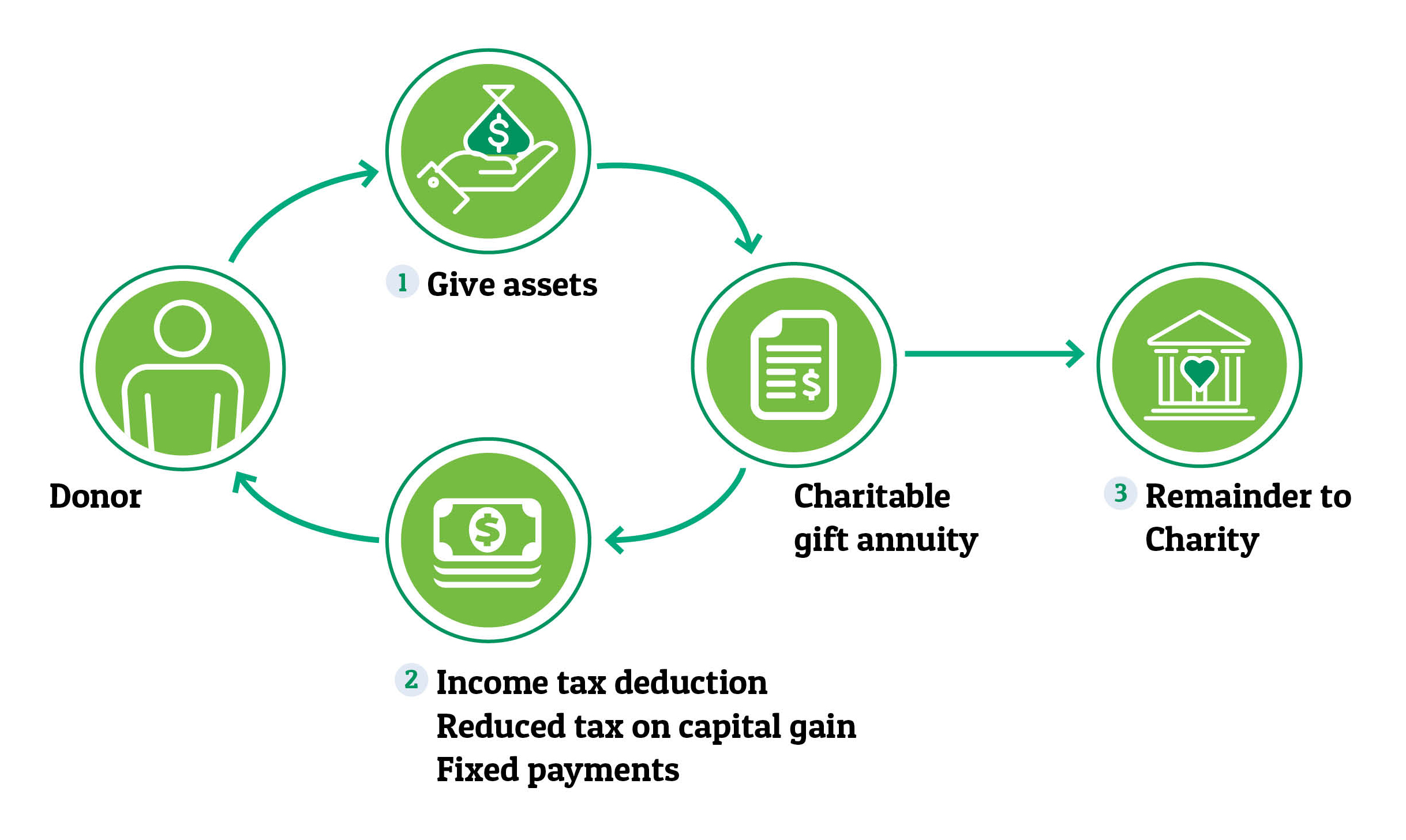

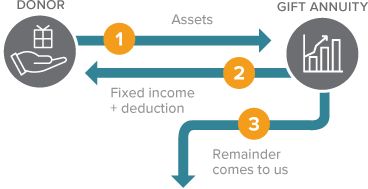

The benefits are three-fold. If your intent is to leave a gift to charity consider a charitable gift annuity instead. Preferable tax treatment hedge your longevity risk and fulfill your calling to give back to the world all at once.

A multi-year guaranteed annuity or MYGA is a type of fixed annuity that offers a guaranteed fixed interest rate for a certain period usually from three to 10 years. Need help with big financial decisions. Preferable tax treatment hedge your longevity risk and fulfill your calling to give back to the world all at once.

Indexed annuities perform well when the financial markets perform well. The size of the estate youd like to leave behind. Certain interest expenses charitable contributions casualty and theft losses and certain.

If your intent is to leave a gift to charity consider a charitable gift annuity instead. Apply for a loan Ministry Finances Eating You Alive. A Charitable Remainder Unitrust CRUT pays out a fixed percentage of the trust value each year.

An indexed annuity also known as a fixed-index or equity-indexed annuity features income payments tied to a stock index such as the SP 500. Bring your ministry vision to life with a loan from WatersEdge. A financial template is a great resource to generate a monthly budget track spending and manage your debt.

The Taxpayer Certainty and Disaster Relief Act of 2020 waived this requirement in 2020 and the waiver still applies for tax year 2021. The size of the estate youd like to leave behind. For example if a taxpayer made a gift of 5000000 today when the exemption amount is 12060000 and the exemption amount is reduced to 7000000 in 2026 the taxpayer would only have.

Any relevant capital gains will be taxed at the current owners tax bracket. Download The Guide If You Can Dream It We Can Finance It. View the 2022 RRIF minimum withdrawal table.

Charitable Gift Annuities National Wildlife Federation

Gifts That Pay You Income Fred Hutchinson Cancer Research Center

Charitable Gift Annuities Giving To Stanford

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home

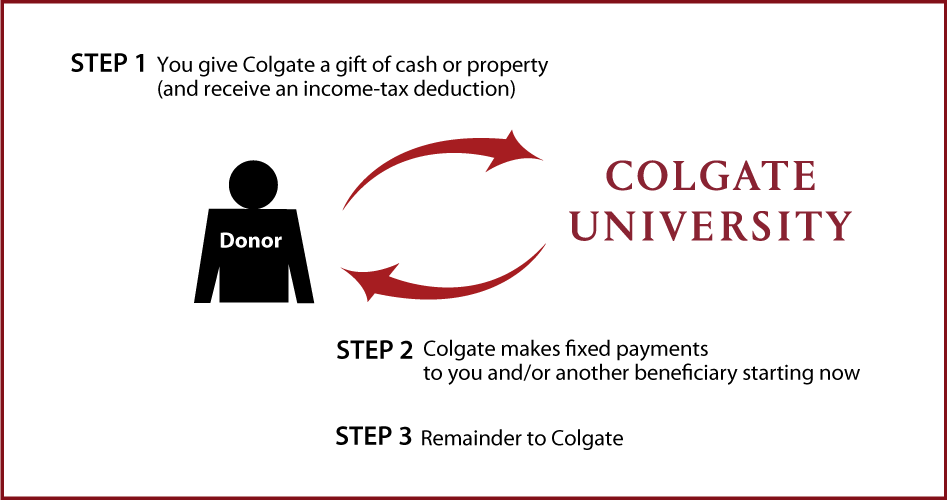

Colgate Planned Giving Charitable Gift Annuity

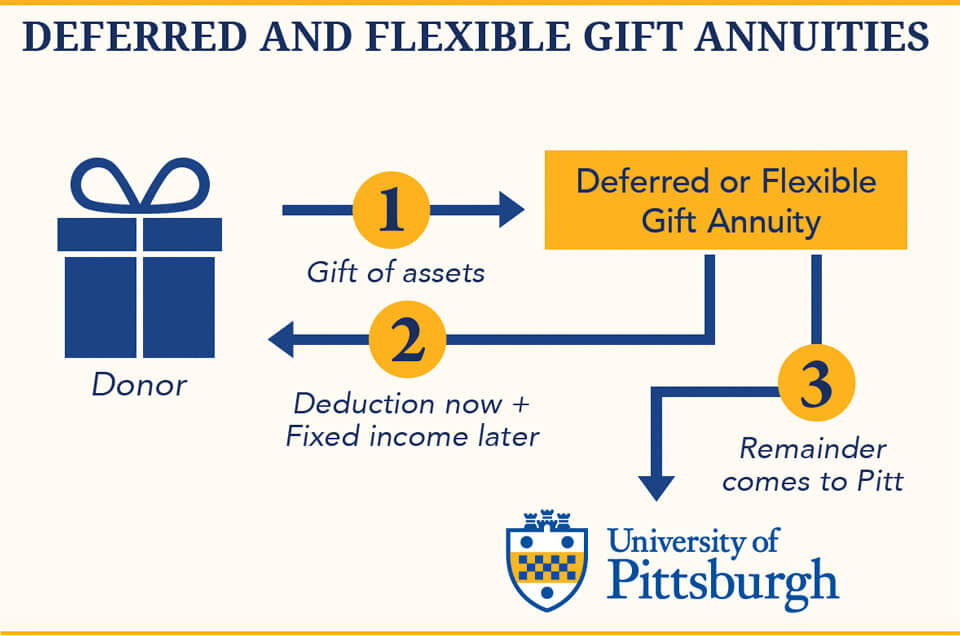

Charitable Gift Annuities The University Of Pittsburgh

Gifts That Provide Income Giving To Mit

Charitable Gift Annuities Kqed

Charitable Gift Annuity Focus On The Family

Charitable Gift Annuity The Als Association

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuities Giving To Duke

Charitable Gift Annuity Claremont Mckenna College

Gifts That Pay You Income Girl Scouts Of The Usa

Charitable Gift Annuities University Of Montana Foundation University Of Montana

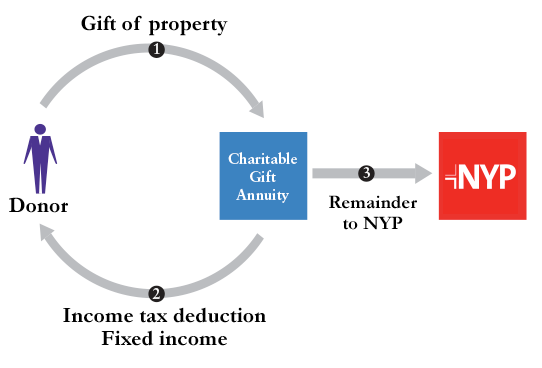

Nyp Giving Planned Giving Gifts That Provide Income Charitable Gift Annuity Nyp